Oh, god, I'm going to talk about money.

Let me be clear about something: I'm not really very good with it. My feelings can best be summed up as "if I has it, I spends it." Of course, there are people out there who are much worse than I am - I'm not actually accruing any debt or anything - but I'll be the first to admit that I'm terrible at saving.

I know I've mentioned the furniture business Brian and his brother started, but something that I haven't talked much about is how upset Brian has been lately that he can't spend as much time as he'd like working on it. They've been having some success, and I know he's felt like he's not as much a part of it as he'd like to be. They're doing commissions, collaborating with artists, and getting their pieces into stores, and he really wants to be there to help it keep growing.

I told him a while back that I would help him even if he quit his job, that we'd find some way to make things work. Thankfully, he's not doing anything that extreme, but he is moving to a part time position and will be making about half of what he currently makes. Cue mild panic on my part.

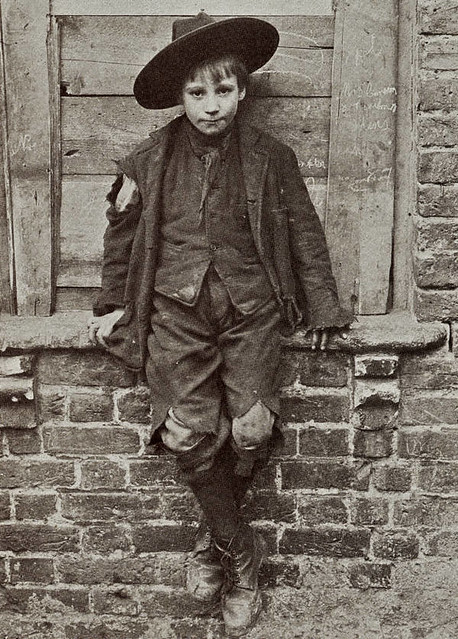

The Prince and the Pauper

Ok, yes, I know I told him that I'd support him, we'd make it work, blah blah blah. He's still going to be able to pay his portion of the rent, but after things like transportation and his cell phone bill, he's not going to have much of anything left over. Our utilities are included in our rent, so yay for that, but I'm going to be taking over all of our other household expenses, like groceries. Since he won't be able to buy his lunch anymore, which he currently does most days, I'm going to have to cook more and bigger meals to make sure there's food around the house.

Don't start with me about feeling like I have to cook for him. I like to cook, and I'm also kind of anal retentive about my kitchen, in that I don't really like other people using it. I'll shop and cook, he'll do the dishes, everyone will be happy and fed. I'm still a good feminist, even if I spend a good portion of my time barefoot in my kitchen.

We sat down and figured out what our expenses are, and after everything, I've still got a little bit left over. Enough to go out for dinner once in a while, or buy a new skirt or dress clip, or buy my coffee on a regular basis. Not all of the above.

Not quite where I'll be at.

I'm going to have to start making some smarter choices about how I spend my money. I like to buy things, and not spending money on things that I want, but don't necessarily need, is always a struggle for me. I'm sure I can adapt to my new budget, but I also know it'll take some time before I get used to the new status quo.

I guess it's a good thing, in a way. It's easy to be stupid with my money when I have extra. I don't think about my purchases as much, and when I buy something, a lot of the time it's with an air more of "why not?" instead of "why?" I'm also kind of excited to be cooking more often. It's something that I was really passionate about for a time, and while I still cook regularly, I don't put a lot of thought into what I make. You'll definitely start seeing recipe posts here more often.

I hope I don't sound terribly entitled. I grew up pretty poor, and now that I have enough money not to be struggling all the time, I really appreciate it, and it's going to be hard to start watching my pennies all the time again.

How have you dealt with budgeting difficulties? Is there anything that you recommend to help avoid missing spending money that you don't have anymore?

What an admirable outlook, dear gal. I too have a strange relationship with money (something that I only admitted publicly, and privately before that only to Tony, this past July) that stretches, as oh-so-many things do in life, back to my childhood and a lot of traumatic events in which money was involved. Though I can save and budget with the best of them, at and this point in my life do consider myself to usually be quite financially responsible, I'm a stress spender (which is a dangerous combination when you're also a natural born worrier) and have to diligently work extremely hard to curb my desire to spend when trouble strikes, or at the very least to keep my "sprees" to a quick and inexpensive minimum when they do strike (case in point, I went on one this past August and spent less than $250, which is still a ton of money, don't get me wrong, but for me that's one of the better stress shopping benders I've gone on over the years).

ReplyDeleteI find that channeling my energy into creating (taking photos, writing posts, doing crafts, listing items in my Etsy shop, etc) is the #1 best way to counterbalance those urges when they strike and as such, these days, I can thankfully go months between stress spending occurrences and instead just make very conscious shopping choices with my modest budget (which is being halved yet again to try and help our household budget come the new year - thus making such stress sprees something that must happen even less often) when I do go shopping. I doubt I'll ever stop stress spending entirely, but at least I'm better equipped to handle the urge and keep the damage to my wallet from being too horribly brutal when I do. Money eh?!

Here's to the hope that we both do well on the personal finances front as we head towards 2015 and beyond.

♥ Jessica

I'm so slow about responding to comments these days!

DeleteThank you so much for sharing that. Sometimes I wonder if I don't have a form of shopping addiction - when I know I'm going to have some extra cash, I'll start making lists, searching online stores, doing pros and cons of each items, checking and rechecking my math to see how much I can spend, and then once I finally buy sometime, it's like this rush of relief. I feel weirdly down if money's tight and I can't buy anything at all for a while. I'm definitely going to try and take your advice and turn to something creative next time the urge takes me, though, since feeling like I have to buy a new outfit every month is so wasteful.

Let me start off by saying you are on the right track with cooking at home as much as you can and having Brian take left overs to work. Ian and I have been doing this for the last month and it has made a huge difference! In the last 3 years together Ian and I's finances have changed so many times its hard to keep up. From both of us with decent jobs, to my back injury and not working at all, to his being laid off and going months without a new job (that was hell, neither of us working) it has been a rollercoaster of financial stress. Now, with him working full time and me bringing in temporary disability, things are at least stable. When this chapter in our financial history started I an was stopping by the convenience store every morning (6 days a week) and spending 10-15$ on breakfast and lunch and smokes. Holy crap does that add up!!! We've both quit smoking and now I make sure to cook enough food for dinner so that he'll have lunch the next day. We also buy soups and snacks at the grocery store for him to take to work instead of convenience store crap. Although we may spend a few extra dollars at the grocery store, it is well worth it. I am a serious shopaholic but thankfully I have always been one to prefer Value Village to Nordstrom. Now, when I ask myself "Why Not?", I actually will answer the question. Because I already have 4 cardigans that are black and white prints. Because it's 20* outside and I don't need a new sun dress. Because Christmas is coming........ It has really helped me out. I now talk myself out of those impulse buys that I spent years making. It's weird and a big change, but my bank account is much happier for it and so is our relationship as we have less "talks" about money. We can still be our vintage diva selves without breaking the bank. Good luck to you and your man in his new business venture.

ReplyDeleteShe Knits in Pearls

I've always cooked for myself and brought my lunch to work, and I'm actually kind of excited about getting Brian to do the same thing. The hard part is really wrapping my mind around how much he eats. We split our grocery bills, but I don't think I realized before how much extra food he buys for himself. Now, it seems like a loaf of bread disappears the day after I buy it. I guess he's a growing boy... *lol*

DeleteAnswering the question for "why not?" is really smart, actually. I'm really good at convincing myself that my bad decisions are actually good ones, and I need to work on seeing through my own bullshit.

Oo, first up, best of luck!! You can do it!! I'm not saying it's going to be easy, (ahem), but it's totally do-able. Here in the UK we have a super-duper website called MoneySavingExpert.com which is run by financial guru Martin Lewis. He's very passionate about not wasting money. You might have an equivalent site over there? But if not, check out the UK one anyway and start with the budget checker and things like that. There's basically 2 prongs to the approach: 1) stop spending so much (get a cheaper phone contract, buy cheaper groceries, get a bank account with less fees) and 2) earn more (e.g. join market research panels, sell bits on Ebay to help raise more funds too).

ReplyDeleteIn terms of what I personally do - grocery shopping has changed massively for us, it's all cooked from scratch, like you're proposing to do, and that has made such a big difference. We try and eat what's in season (it's cheaper), we grow a few little things in our garden (courgettes are easy-peasy) and if things are on offer, that's what we buy. We also shop at times of the day when we're guaranteed to get a few reduced items to throw in our trolley (big bags of bananas for 10 pence!). It helps if you have a specific goal in mind too. We had to really sacrifice a social life and we lived apart in separate shared houses for many years to be able to save up enough money to get a place together, but it's been SO worth it. I work 4 days a week (that's all they could afford to give me!!) and my Baby is a self-employed musician, so our total income is about the average for just one person rather than a couple, so have faith that it can be done!

x

That must have been so rough, spending so long apart. But congrats on getting things squared away. We're definitely going to have to be a little strict with ourselves, at least for a little while, but I think it's worth it to get his dream off the ground.

DeleteI wish him luck with his business. It sounds like things could really boom for him and thats so great that you support him. I totally with you there, Im not in debt (well except for school loans) but Im not very good at saving my money. Im like you, after Ive paid my bills any extra money I have I go oh now I can buy that (insert frivolous clothing/makeup/random item here) cause I have the money. Which is fine I guess cause I did work for the money and its nice to treat yourself but it would be great to have some savings. I have managed to put money aside each week for a trip I want to take but I don't feel like it counts because its joint savings between my boyfriend and I. I feel like its different when theres someone along side you trying to save and pushing you to save for something specific too. Its great that you are being so optimistic and seeing this as a way to cook more, pursuing something you love. And who knows even though your boyfriend is only working part time his business could very well make it so you can have more money for himself soon enough. If you do come across and nifty financial advice websites or accounts then let me know. Although Im sure theres some app out there, Ive just never looked into it.

ReplyDeleteJustine

http://theredlipchronicles.blogspot.com

I've never really looked into it either. The thing is, I know where I can save a few bucks here and there, the hard part is doing it. I have this weird thing where I don't like coffee that I brew at home, so every day I buy it - that's $60 a month right there. Or buying a snack instead of bringing one. Grabbing drinks with people after work. Money can't buy happiness, but fun can be kind of expensive.

DeleteOoh I'm so full of opinions about money and budgets that I don't know where to start! And everyone has given such great advice already. I love the idea from Cherry about actually answering the "Why Not?" question. And I totally second Jessica's idea of having something else to turn to when you want to shop. I believe it is important to have an idea of what emotional need the spending is satisfying, and have alternatives ready to go when that need strikes. Creative things are very good, trying on the clothes and accessories you have would be a fun reminder of what you already have (if the need is about having pretty stuff and dressing up), or mending or altering clothes that don't quite fit right, and using that new sewing machine to make things for yourself too! I'm focusing on the vintage clothes spending, because I know you've mentioned it and it's always a big temptation. I am a huge fan of thrift-shopping, and although you might not find much amazing vintage, you will find plenty of cheap vintage-appropriate, as well as possibly patterns and fabric if you want to do some sewing. You could also consider clothes swapping as a way to get some great new things for free. I went to one in-person clothes swap and it was pretty fun and successful (especially since I mostly gave up things that didn't fit me any more).

ReplyDeleteThere are lots of great resources online about saving money, particularly about looking at your current spendings etc. I know we have a government site that is quite helpful, and you may have something similar too. You will certainly save a significant amount the more you cook at home instead of buying meals, and by getting seasonal fruits and veggies, non-brand-name products etc.

I think that really considering each purchase and questioning whether things are really "needs" or "wants" is simple but effective. I often find that by just waiting a while before making a purchase, I discover I can actually live without it, or fix what I have, or work around the problem.

I sympathise very much with Brian and the frustration of not being able to pursue your passion because of work. Taking this year off from my job was so liberating and gave me time to really throw myself into creating. (Of course, getting pregnant took some of that time away again, but it all worked out!) I hope everything goes well for them. As I've said before, their creations are awesome and they deserve success with them.

I also am very much the same about my kitchen. My husband and I were trying to keep all our chores equally split, but we realised (happily) that we like different jobs, so now I do most of the cooking, and keep the kitchen clean, because I enjoy it more than he does, and he doesn't mind some cleaning jobs that I really hate! It's a more efficient division of labour to specialise in particular tasks, as well :)

You are really, really right about thrifting instead of always wanting to buy vintage. I've bought some really great stuff from thrift stores, but I never make the time to visit them! It's so much easier to sit on the computer and just search for stuff when I'm on down time at work, rather than getting out on the weekend and trying to take care of it. I think I need to enlist a thrifting buddy, that would probably make it more fun.

DeleteWe're figuring out how we like to divide up labor. I'm better at getting groceries and cooking than he is, but I hate taking out the trash and doing dishes, so we're going to split things up that way. I think we'll make it work.